Franchise Intel Report: Q Burger (Taiwan)

HQ: Taipei, Taiwan | Founded: 2004 | Franchising since: 2008

Data Freshness: As of September 29, 2025, the most recent FDD available to us for this brand is 2024. If newer data has been publicly disclosed, please share it with us, and we’ll update this report immediately.

🔍 Fast Facts

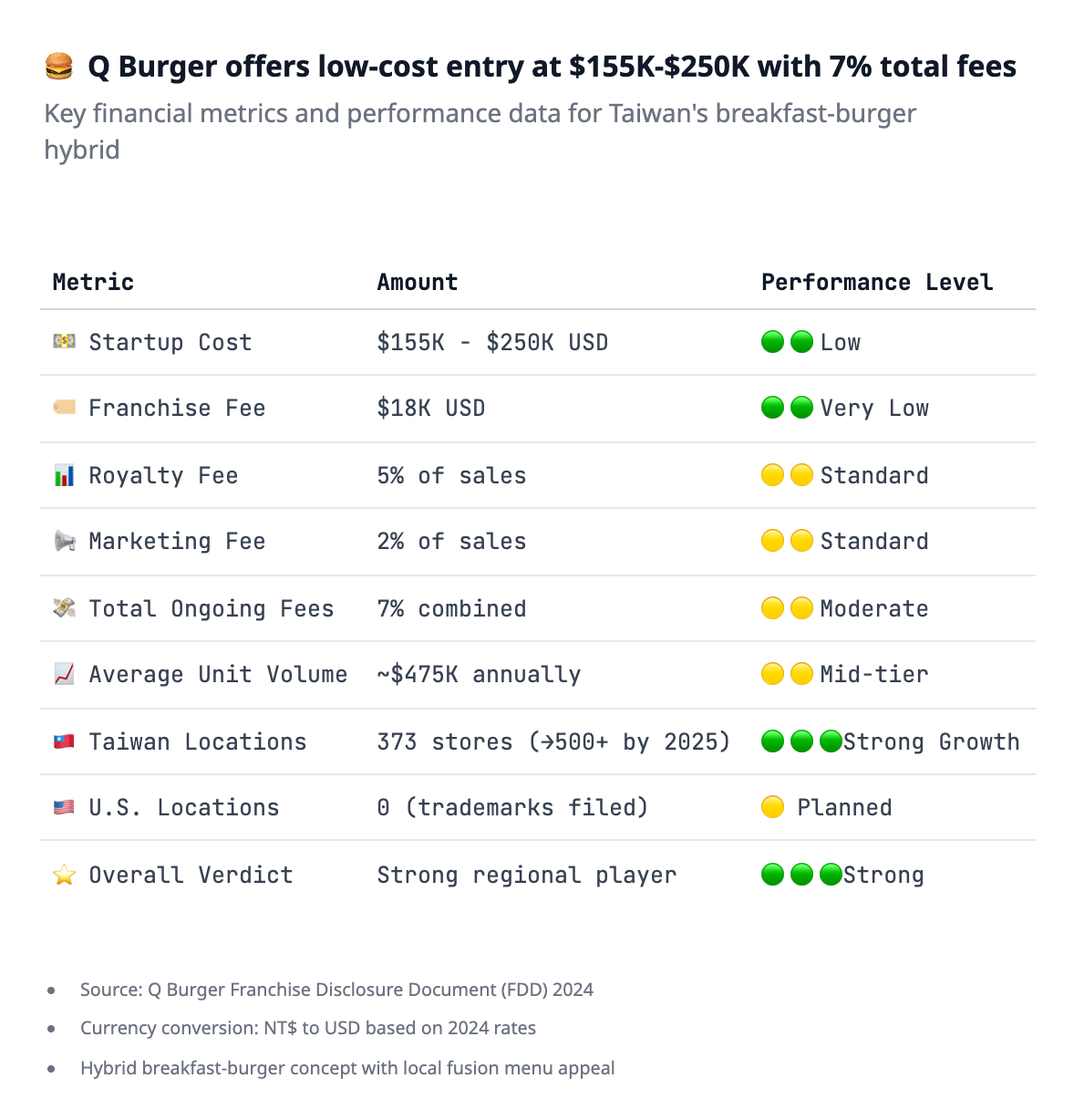

Startup Cost: NT$5–8M (~$155K–$250K USD) estimate

Franchise Fee: NT$600K (~$18K USD)

Royalty / Marketing: 5% + 2%

Item 19 + AUV: Avg. NT$15M/store (~$475K USD) [2024 est.]

U.S. Locations: 0 (373 units in Taiwan, expanding toward 500+ by 2025)

🧾 FDD Disclosure & Freshness

Most recent FDD we’re using: 2024 FDD (disclosed 2024)

Why this dataset: It is the latest publicly available version as of September 29, 2025. If the 2025 FDD exists but isn’t yet publicly accessible, we default to the most recent public filing to ensure consistency and verifiability.

Brand representatives: If you have more current, documented figures (AUV, quartiles, fees, unit counts, and training/support), please notify us, and we’ll publish an update note with the new numbers.

What’s Our Verdict on This Brand?

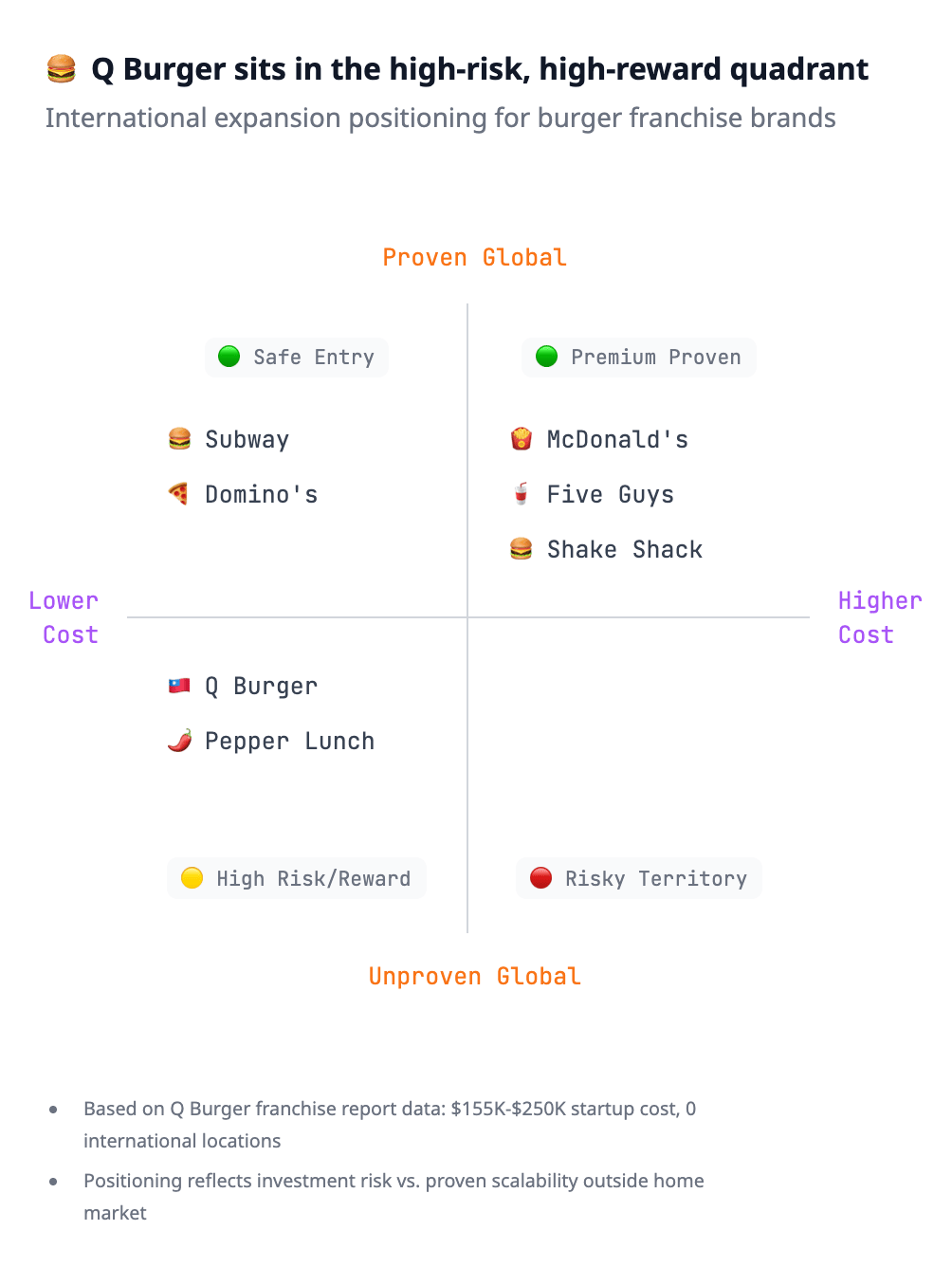

Verdict: 🟢 Strong — aggressive regional player with international trademarks filed.

📊 Why the Verdict?

🍔 Hybrid Positioning

Why it matters: A unique identity strengthens the moat against Western giants.

Investor Move: 🟢 Strong play for Asian expansion and future U.S. entry.

🌏 Expansion Pipeline

Targeting 500+ stores by the end of 2025; trademarks filed in the U.S., Canada, and Southeast Asia.

Why it matters: Signals intent to go global, not just domestic saturation.

Investor Move: 🟢 Track early U.S. entry points — ground floor opportunity.

💸 CapEx & Fees

Startup <$250K with reasonable fees. Lower than typical U.S. burger QSRs.

Why it matters: An affordable entry point widens the franchise pool.

Investor Move: 🟢 Potentially faster adoption once U.S. expansion starts.

🚨 Red Flag Alert

Unproven outside Taiwan

Volatile consumer trends in the breakfast/burger hybrid space

Thin financial reporting in English

Why it matters: Risk of misread demand + transparency issues.

Investor Move: Watch how they perform in Southeast Asia before betting on the U.S. launch.

📱 What’s Driving Demand?

Affordable all-day dining

Fusion menu appeal (burgers + egg rolls + local sides)

Growing middle class in Asia

Social buzz around “local burger identity” vs. U.S. imports

Why it matters: Burger QSR growth in Asia is no longer just about McDonald’s.

Investor Move: 🟢 Strong positioning if Western giants stumble on local taste.

🔎 Public Sentiment

Customer Feedback

“Good value vs. McDonald’s breakfast”

“Local flavor, not generic fast food”

“Stores feel modern, not greasy”

Employee/Insider Feedback

“Standardized operations, but training depth varies.”

“Better culture than global chains, but less career pathing”

Why it matters: Solid brand equity at home; execution abroad remains a question.

Investor Move: Good buzz baseline, but the franchisee training system needs to be scaled.

💡 Training + Support

Initial 6–8 weeks + supply chain support, but largely domestic-focused.

Why it matters: Needs an upgrade before global franchising can occur.

Investor Move: 🟡 Keep on watch — not yet export-ready.

📊 Fees at a Glance

Franchise Fee: ~$18K USD

Royalty Fee: 5%

Marketing Fee: 2%

👷 Operator Lens ROI Snapshot

Domestic performance suggests breakeven in roughly 18–24 months, with net margins in the mid-teens once stores mature. Growth has been steady, but without U.S. unit economics, operators should treat early entries as pilot investments and model conservatively.

📈 Investor Lens Scalability & Exit

The public listing provides access to capital and visibility, but international scalability remains untested. If product-market fit holds outside Taiwan, area-development or JV structures could create meaningful upside. Until then, exit options are limited to regional growth stories rather than global resale opportunities.

⬇️ Final Call

Q Burger is not your typical U.S. better-burger play. It’s a Taiwanese hybrid brand scaling fast, with global ambitions and affordable unit economics. The risk is high, but the upside for early operators is substantial.

Verdict: 🟢 — a brand to watch now, before they hit U.S. soil.

Data Freshness: As of September 29, 2025, the most recent FDD available to us for this brand is 2024. If newer data has been publicly disclosed, please share it with us, and we’ll update this report immediately.