Franchise Intel Report: Domino’s (Q3 2025 Earnings Lens)

HQ: Ann Arbor, MI | Founded: 1960 | Franchising since: 1967

🔍 Fast Facts

• Startup Cost: $145K – $638K

• Franchise Fee: $10K

• Royalty / Marketing: 5.5% / 4%

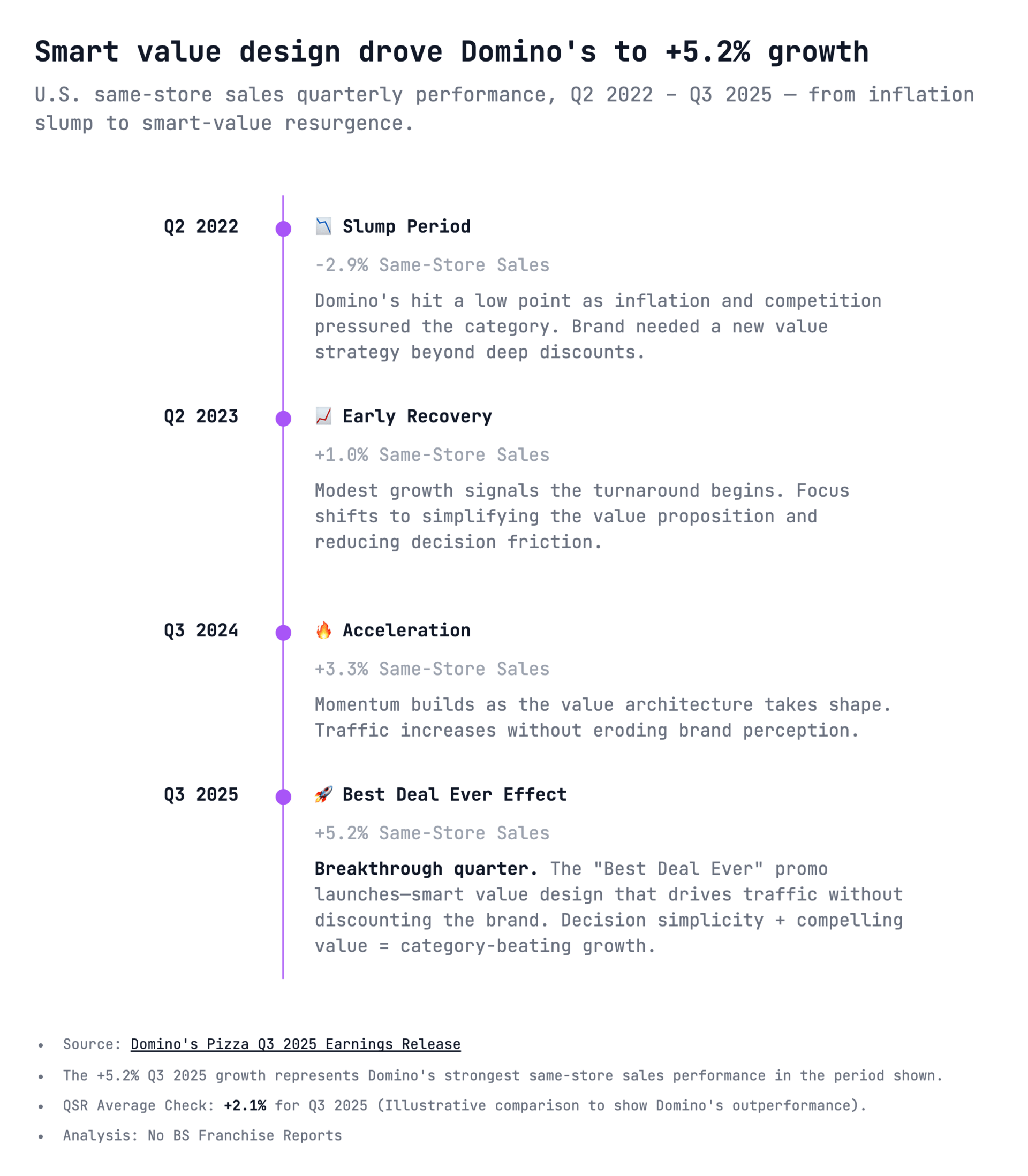

• 2025 Q3 AUV / Item 19: Est. $1.4 M (2024 FDD) | +5.2% U.S. same-store growth this quarter

• System Size: ~20,500 global units (+36 closures in Q3)

What’s Our Verdict on This Brand?

Verdict: 🟡 A strong domestic engine with international slippage and margin compression that can no longer be ignored.

⚠️ Disclaimer

We are not affiliated with or endorsed by Domino’s Pizza, Inc. or any of its subsidiaries. All content is for informational purposes only. Conduct your own due diligence before making business decisions.

📊 Why the Verdict?

🍕 Domestic Momentum Still Delivers

U.S. same-store sales rose 5.2%, proving brand promotions (“Best Deal Ever,” stuffed-crust launch) are resonating.

Why it matters: Strong traffic means franchise cash flow remains resilient.

Investor Move: 🟢 Hold confidence in U.S. unit-level returns short-term.

💸 Margin Compression Creeps In

Company-owned store margins fell ~0.5 pts as cheese and pork costs rose.

Why it matters: Food inflation can strain franchise royalties and trigger menu price wars.

Investor Move: 🟡 Watch input cost trends and menu pricing leverage.

🌍 International Flatline

Global comps only +1.7%; 35 stores closed abroad.

Why it matters: Currency and unit economics abroad limit the growth story.

Investor Move: 🔴 Avoid projecting international expansion as a profit fuel.

🎯 Rebrand Signals Long Game

New logo, packaging, and Shaboozey jingle mark a pivot toward emotional relevance.

Why it matters: Domino’s is buying attention to offset value fatigue.

Investor Move: 🟢 Brand investment can extend life cycle if execution stays tight.

🚨 Red Flag Alert

• 36 store closures (1 U.S., 35 international)

• Rising commodity and labor costs

• Margin erosion behind headline growth

Why it matters: Growth without profit signals a tightrope between market share and franchise ROI.

Investor Move: 🟡 Treat 2025 as a reset year — not a growth surge.

📱 What’s Driving Demand?

• Aggressive value offers ($9.99 “Best Deal Ever”)

• Stuffed Crust line and innovation pipeline

• Third-party delivery integrations (DoorDash, Uber Eats)

Why it matters: Re-engaging price-sensitive customers protects traffic through 2025.

Investor Move: 🟢 Short-term sales support; long-term margin watch.

🔎 Public Sentiment

Customer Feedback

• Positive response to new menu items and delivery ease.

• Mixed reaction to rebrand (logo seen as “too simple”).

Employee/Insider

• Store staff report tight labor and bonus pressure.

• Franchisees voicing cost concerns in forums.

Why it matters: Morale and margin both impact execution.

Investor Move: 🟡 Monitor unit sentiment as a leading indicator of turnover.

💡 Training + Support

Domino’s maintains top-tier training infrastructure and supply chain scale, but operators note reduced local field support in some markets.

Why it matters: Support density declines as the system expands.

Investor Move: 🟢 Strong systems; watch for regional support gaps.

📊 Fees at a Glance

• Franchise Fee: $10,000

• Royalty Fee: 5.5% of sales

• Marketing Fee: 4%

👷 Operator Lens ROI Snapshot

Average store AUV ~ $1.4 M → net operator margin typically ~18–20%.

2025 margin compression could trim 2 pts if inflation persists.

Why it matters: ROI remains strong but tightening — new franchisees need realistic cash flow models.

Investor Move: 🟡 Model lower unit margins through mid-2026.

💰 Investor Lens Scalability & Exit

Market cap $14 B | EPS $4.08 (beat) | Revenue $1.15 B (+6.2%)

Still a cash machine with buybacks and low debt, but international weakness caps the expansion story.

Why it matters: A mature brand in maintenance mode.

Investor Move: 🟡 Hold for stability, not hyper-growth.

⬇️ Final Call

Domino’s proved once again it can outperform on the top line even when costs rise. Yet beneath that beat lies a system in balance mode — managing labor, ingredients, and value perception simultaneously. For operators and investors alike, 2025 is less about expansion and more about preserving margins while the brand reinvents itself.

Verdict: 🟡 Solid core, tightening margins — a maintenance play, not a moonshot.

💥 Stay Ahead of the Hype

Every week, we drop one Free Intel Report — no fluff, no paywall. Just raw franchise data, decoded.

Subscribers get early access to:

🟢 Weekly brand breakdowns

🟡 Operator & investor metrics

🔴 Red-flag alerts hidden in FDD fine print

🧠 Want to Pressure-Test Another Brand?

If you’re evaluating a franchise — or already signed an LOI — don’t rely on the brochure.

We’ll run a full No BS Intel Report on your brand:

✅ Verified FDD data

✅ Red/Yellow/Green grading system

✅ Operator + investor lens analysis